Vision vs Medical Insurance: Save Money on Eye Care

Key Takeaways

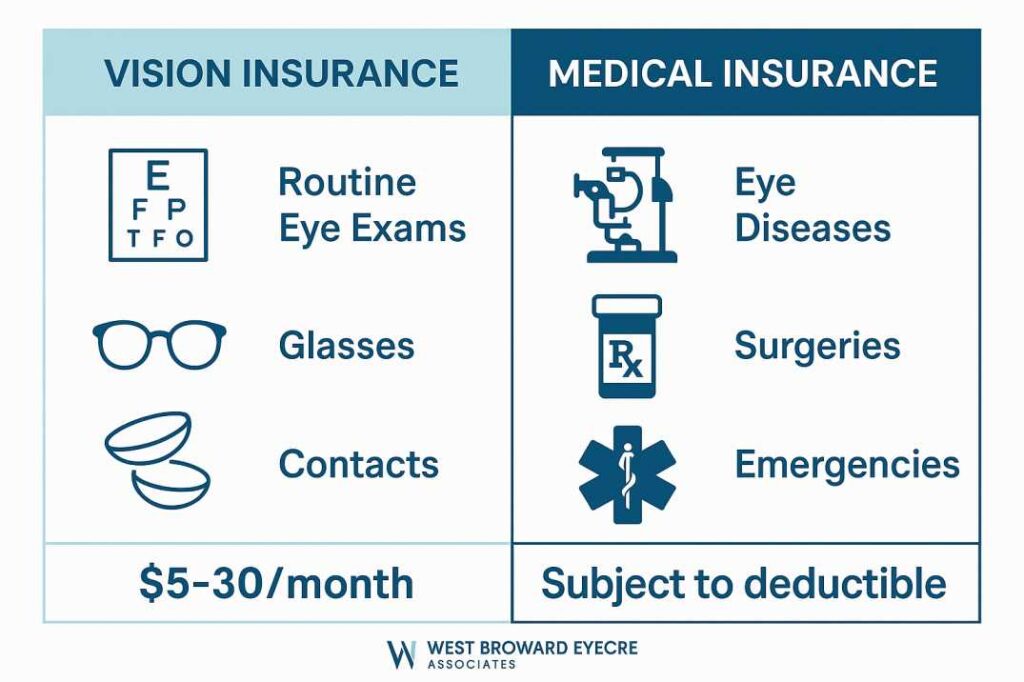

Understanding the difference between vision insurance and medical insurance can save families hundreds of dollars in eye care costs. Vision insurance covers routine eye exams, glasses, and contacts, while medical insurance handles eye diseases, injuries, and medical conditions affecting your vision. Most families benefit from having both types of coverage for complete eye health protection.

Understanding the Difference: Vision Insurance vs Medical Insurance for Eye Care

Vision insurance and medical insurance serve different purposes in protecting your eye health. Vision insurance functions as a discount plan for routine eye care, covering annual exams, glasses, and contact lenses. Medical insurance handles eye diseases, injuries, and medical conditions requiring treatment by healthcare professionals.

If you’ve ever wondered whether your eye appointment falls under medical insurance or vision insurance, you’re not alone. This confusion affects millions of Americans, especially families where preventive eye care is essential for children’s development and seniors managing age-related eye conditions.

Understanding the distinction between vision insurance vs medical insurance determines whether your family gets the right care at the right time and helps avoid unexpected costs.

What Is Vision Insurance? Complete Coverage Breakdown

Vision insurance functions more like a discount plan than traditional insurance. It’s designed to help with the predictable, routine costs of maintaining good eye health and clear vision coverage.

What Vision Insurance Covers

Routine Eye Examinations

- Annual comprehensive eye exams for vision screening

- Refraction tests to determine glasses prescriptions

- Eye dilation and basic vision assessments

- Coverage typically ranges from $10-50 copays

Prescription Eyewear

- Eyeglass frames (usually $130-200 allowance)

- Standard prescription lenses

- Contact lens fittings and supplies

- Upgrades like anti-reflective coating (often discounted)

Preventive Care Benefits

- Early detection of vision changes

- Monitoring for prescription updates

- Basic eye health screenings

Vision Insurance Limitations

Vision insurance has significant limitations that many families discover too late. It typically excludes medical eye conditions such as:

- Dry eyes and eye infections

- Glaucoma and elevated eye pressure

- Cataracts and lens clouding

- Diabetic retinopathy from diabetes complications

- Macular degeneration and retinal conditions

Emergency eye care, eye injuries, and most eye surgeries also fall outside vision insurance coverage.

What Is Medical Insurance? Your Health Insurance for Eye Care

Medical insurance treats your eyes as part of your overall health, covering conditions that require medical diagnosis, treatment, or management by healthcare professionals.

What Medical Insurance Covers for Eye Care

Eye Diseases and Conditions

- Glaucoma diagnosis and treatment

- Cataract evaluation and cataract surgery

- Diabetic retinopathy management

- Macular degeneration treatments

- Dry eye syndrome therapy

Eye Injuries and Emergencies

- Trauma to the eye or surrounding tissues

- Foreign objects in the eye

- Chemical burns or exposure

- Sudden vision loss

- Eye infections requiring medical treatment

Medically Necessary Procedures

- Surgical interventions for eye diseases

- Diagnostic testing (OCT scans, visual field tests)

- Injections for retinal conditions

- Laser treatments for medical conditions

Medical vs. Routine Eye Exams

The key difference lies in the purpose and findings of your visit. A routine eye exam with no medical problems found typically bills to vision insurance. However, if you have symptoms like eye pain, vision changes, or a medical condition affecting your eyes, the visit becomes medical in nature and is billed to your health insurance.

Key Differences: Vision Insurance vs Medical Insurance Comparison

| Aspect | Vision Insurance | Medical Insurance |

|---|---|---|

| Primary Purpose | Routine eye care and vision correction | Medical eye conditions and diseases |

| Annual Costs | $60-420 per year | Varies with medical plan deductible |

| Coverage Focus | Preventive care, glasses, contacts | Treatment, diagnosis, and eye surgery |

| Provider Network | Limited to vision plan providers | Broader network of eye specialists |

| Claim Processing | Pre-set allowances and copays | Subject to deductibles and coinsurance |

| Emergency Care | Not covered | Covered for urgent eye problems |

When Each Insurance Type Applies: Provider and Billing Guidelines

Understanding which provider bills which insurance can prevent confusion at your appointment.

Optometrists (OD) typically bill vision insurance for routine exams, but will bill medical insurance if they discover or treat eye diseases during your visit.

Ophthalmologists (MD) are medical doctors who primarily bill medical insurance, even for comprehensive eye exams, because they’re trained to diagnose and treat eye diseases.

At eye care practices, staff help determine the appropriate insurance billing based on your specific needs and examination findings.

Comprehensive Coverage: Why Families Need Both Insurance Types

For families across diverse communities, having both types of coverage provides complete eye health protection across all life stages.

For Growing Children

Families with school-age children benefit significantly from vision insurance covering annual school-required eye exams and the frequent prescription changes common in developing eyes. However, medical insurance becomes crucial if a child develops conditions like amblyopia (lazy eye) or needs specialized pediatric eye care.

For Active Adults

Working adults often develop digital eye strain, dry eyes from environmental factors, or early signs of glaucoma. Vision insurance handles routine monitoring, while medical insurance covers treatment for these emerging conditions.

For Seniors and Pre-Retirees

Older adults face higher risks for age-related eye diseases. While vision insurance might cover routine monitoring, medical insurance is essential for managing cataracts, glaucoma, and diabetic eye complications that become more common after age 60.

Real-World Insurance Scenarios: When Each Coverage Applies

Scenario 1: Annual Family Eye Exam A family schedules routine eye exams at their local eye care practice. Everyone receives clean bills of eye health with minor prescription updates. This visit bills to their vision insurance with minimal out-of-pocket costs.

Scenario 2: Sudden Vision Changes A patient experiences sudden blurry vision and eye pain. The visit reveals elevated eye pressure, suggesting glaucoma. This becomes a medical visit covered by health insurance, with ongoing treatment managed through medical benefits.

Scenario 3: Diabetic Eye Care A patient with diabetes requires routine diabetic eye screening, which reveals early signs of diabetic retinopathy. The examination is billed to medical insurance because it’s monitoring a systemic disease affecting the eyes.

Cost Analysis: Maximizing Your Benefits

Vision Insurance Investment Most vision plans cost $5-30 monthly for individuals ($60-420 annually), with family plans typically higher. Based on 2025 data, vision insurance provides $130-200 in annual benefits for frames and similar allowances for contacts. For Tamarac families with multiple children needing glasses, this typically results in significant savings.

Medical Insurance Protection. While you can’t predict when eye emergencies or diseases will occur, the average cost of cataract surgery ranges from $3,000-7,000 per eye without insurance (Medicare typically covers 80% of approved charges), demonstrating why medical coverage is essential.

Eye Exam Costs Without insurance, comprehensive eye exams average $136-200 in 2025, though costs can range from $50 at retail chains to $250 at specialty practices. With vision insurance, copays typically range from $10-40 for routine exams.

Insurance Coverage Considerations for Special Populations

Medicare and Vision Care

Many seniors rely on Medicare, which provides limited vision coverage. Original Medicare covers eye exams only when related to medical conditions like diabetes or glaucoma. However, many Medicare Advantage plans available nationwide include vision benefits for routine care.

Medicaid Coverage

Families with Medicaid coverage receive comprehensive eye care benefits, including routine exams, glasses, and medical eye care. Coverage varies by state, so verifying specific benefits is important.

Emergency Preparedness

Living in areas prone to natural disasters means preparing for emergencies. Having backup glasses and contact lenses before emergency situations is crucial, and understanding which insurance covers replacement eyewear can prevent expensive out-of-pocket costs during challenging times.

Navigating Your Coverage: Step-by-Step Guide

Before Your Appointment

- Verify your benefits by calling both insurance companies

- Understand your copays and deductibles for each plan

- Bring both insurance cards to every eye appointment

- List any symptoms or concerns that might indicate medical issues

During Your Visit

Professional eye care staff help determine the appropriate insurance billing based on your examination findings. They’ll explain any costs upfront and work with you to maximize your benefits under both types of coverage.

After Your Visit

If medical conditions are discovered during a routine exam, your care may transition to medical billing. Your provider will clearly explain any changes and help coordinate with your medical insurance for ongoing treatment.

Making the Most of Both Types of Coverage

Timing Your Care

- Schedule routine exams early in your plan year to maximize vision benefits

- Address symptoms immediately rather than waiting for routine appointments

- Plan eyewear purchases strategically to use vision allowances effectively

Working with Providers

Choose an eye care practice like West Broward Eyecare Associates that accepts both types of insurance and can provide seamless transitions between routine and medical care as your needs change.

Common Misconceptions Debunked

Myth: “Vision insurance covers everything related to my eyes.” Reality: Vision insurance only covers routine care and basic eyewear

Myth: “I don’t need vision insurance if I have medical insurance.” Reality: Medical insurance rarely covers routine eye exams or prescription eyewear

Myth: “Eye emergencies are always covered by vision insurance.ce” Reality: Emergency eye care always requires medical insurance

The Future of Eye Care Coverage

Recent studies, including research from the National Eye Institute, emphasize the critical role of preventive eye care in maintaining overall health and quality of life. Vision impairment affects quality of life, independence and has been linked to falls, cognitive decline, and increased healthcare costs, with patients experiencing any vision loss showing 46.7 percent higher healthcare costs compared to those without vision loss.

This research supports the importance of having comprehensive coverage that addresses both preventive care through vision insurance and medical treatment through health insurance.

Expert Recommendations for Tamarac Families

Based on our experience serving West Broward County families, we recommend:

- Maintain both types of coverage when financially feasible

- Prioritize medical insurance if you must choose only one

- Review your benefits annually as coverage options change

- Consider family vision plans for households with multiple children

- Plan for predictable expenses like children’s glasses

Scientific Evidence Supporting Comprehensive Eye Care

Recent research demonstrates the significant impact of accessible eye care on public health outcomes. Studies show that vision impairment affects millions of Americans, including approximately 6.4 million with uncorrectable vision impairment and up to 15.9 million with uncorrected refractive error.

Additionally, The Lancet Global Health Commission emphasizes that high-quality eye health services require promotional, preventive, treatment, and rehabilitative interventions, with vision facilitating better educational outcomes and increased work productivity.

This evidence reinforces why families need coverage for both preventive care and medical treatment to maintain optimal eye health throughout their lives.

Additional Resources and Citations

Key Research and Data Sources

1. National Eye Institute – Vision Impairment Impact Studies

https://www.ncbi.nlm.nih.gov/books/NBK402367/

This comprehensive research from the National Eye Institute documents how vision impairment affects quality of life, independence, and healthcare costs. The study reveals that patients with vision loss experience 46.7% higher healthcare costs, supporting the importance of both preventive and medical eye care coverage.

2. The Lancet Global Health Commission on Global Eye Health https://www.thelancet.com/journals/langlo/article/PIIS2214-109X(20)30488-5/fulltext

This landmark global health study emphasizes that high-quality eye health services require comprehensive promotional, preventive, treatment, and rehabilitative interventions. The research demonstrates how vision facilitates better educational outcomes and increased work productivity, reinforcing why families need coverage for both routine care and medical treatment.

3. Centers for Medicare & Medicaid Services – Cataract Surgery Cost Data

https://www.goodrx.com/health-topic/eye/cataract-surgery-cost

Based on 2021 CMS claims data, this source provides current Medicare cost averages for cataract surgery ($1,587 at ambulatory surgical centers), helping patients understand what to expect from their medical insurance coverage for common eye procedures.

Taking Action: Your Next Steps

Understanding the difference between vision insurance and medical insurance empowers you to make informed decisions about your family’s eye care. The key is recognizing that these two types of coverage work together to provide comprehensive protection for different aspects of your eye health.

Immediate Steps:

- Review your current insurance benefits and coverage details

- Schedule routine eye exams for all family members

- Address any current eye symptoms or concerns promptly

- Consider supplemental vision coverage if not currently available

Long-term Planning:

- Budget for both types of coverage in your family’s healthcare plan

- Establish relationships with providers who accept both insurance types

- Stay informed about changes in coverage options during annual enrollment periods

- Maintain emergency backup eyewear and understand replacement coverage

Investing in comprehensive eye care coverage today protects your family’s vision and overall health for years to come.

At West Broward Eyecare Associates, we understand that insurance can be complex. Our experienced team in Tamarac is here to help you maximize your benefits and receive the eye care you need. Contact us today to learn more about how we can work with your insurance coverage to protect your family’s vision.